A new whistleblower lawsuit filed by Jim Garrity on behalf of a former hospital case manager shines a scorching light on a secret that hospitals know but patients don’t. If you’ve ever wondered why you or a loved one was held so long, and then suddenly discharged without warning, this may be why.

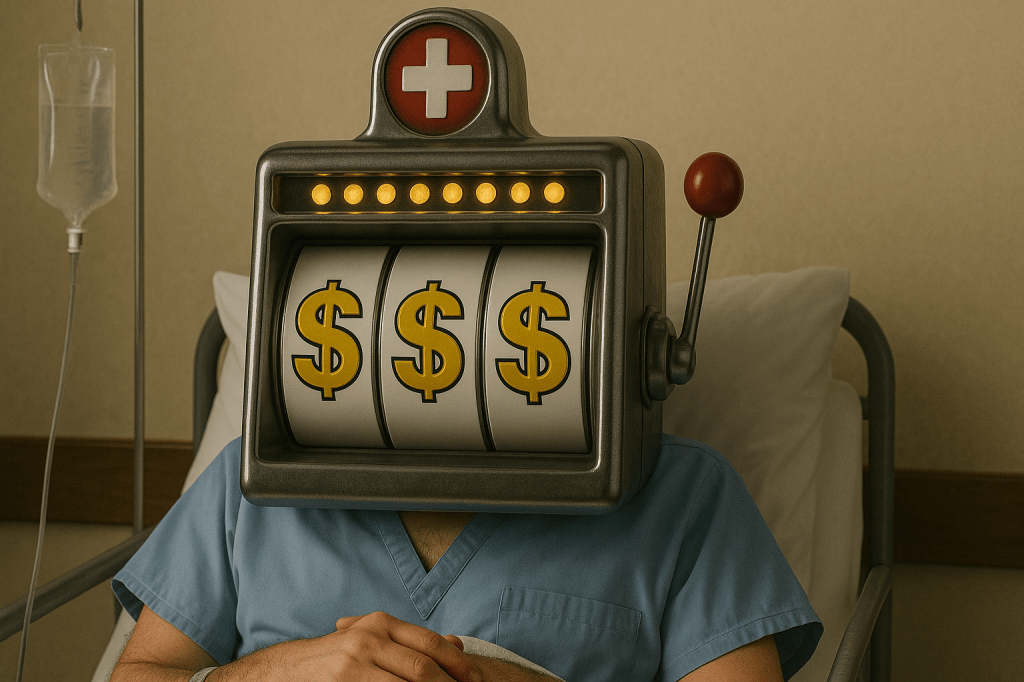

The secret is that some hospitals can maximize revenue by holding patients for a precise number of days – a super-profitable “sweet spot” length-of-stay calculation – and then by swiftly kicking them out when this point passes. For Medicare patients, for example, hospital stays that last between 22 and 26 days – the so-called “sweet spot” – will trigger full reimbursement payments. Once the stay passes this point, though, the reimbursement rate drops sharply, meaning the patient is now “unprofitable.” That’s the moment when a nurse rolls in at 7:00 AM and makes the surprise announcement, “You’re being discharged!” The swift end often comes as a shock to patients, who know they’re not ready to go home.

And they never know what drove the sudden ejection.

But case managers know. In fact, we regularly get called by case managers who were fired because they wouldn’t hold patients just to hit the sweet spot. They care about patients, not profits.

It’s a very ugly business. And it isn’t limited to Medicare. It happens with other forms of insurance as well.

Here, our client’s lengthy whistleblower lawsuit alleges, in part, that:

Plaintiff was a registered nurse and case manager… She was wrongfully terminated at least in part after repeatedly objecting to and reporting patient discharge practices… As [the hospital] pressured Plaintiff, her role bore little resemblance to ethical case management. Instead, she was routinely pressured to lengthen or shorten patient stays, and to engage in other unsavory practices, based on the profit-making goals of Defendant. Her case manager title might well have been “length-of-stay strategist” or

“profit maximization officer,” as she was instructed to prioritize reimbursement targets over patient needs, and to treat care decisions as revenue opportunities. During her employment, [she] objected to premature discharges, unnecessary extensions of care, improper admissions, and pressure to alter billing codes. Her complaints were met with threats, reprimands, and escalating retaliation, culminating in her dismissal on false grounds.

The complaint asserts that her firing was in direct response to her whistleblowing efforts and constitutes retaliation under federal and Florida law.

If you work in the healthcare business and you’re fired because you placed patient care over profits, call us at 1-800-663-7999, or email Jim Garrity directly at Jim@JimGarrityLaw.com. We can help, by advising you of your rights and by pursuing claims to enforce those rights.

Categories: Medicare Fraud, Whistleblowers

Leave a comment